There are millions of motor accidents in the US every year, leading to huge amounts of physical and financial harm. Not only does the risk of having an accident depend on the area you’re driving in, but so too does the financial risk that may come after.

Additionally, many drivers assume that meeting their state’s minimum insurance requirements means they’re financially protected. However, the coverage provided by following state minimums often falls well short of the exposure created by a serious crash, leaving many drivers unknowingly underinsured.

We gathered data and built a state-by-state index, measuring the risk of driving without thorough insurance coverage, regardless of statutory minimums. The index combines crash rates per registered driver, the prevalence of uninsured drivers, the extent of state insurance minimums, average motor tort costs per injury crash, and the likelihood and scale of extreme motor-vehicle verdicts. Then, we combined them all into an Under-Insurance Risk Index to find out where driving with inadequate coverage puts drivers at the most risk of serious financial harm.

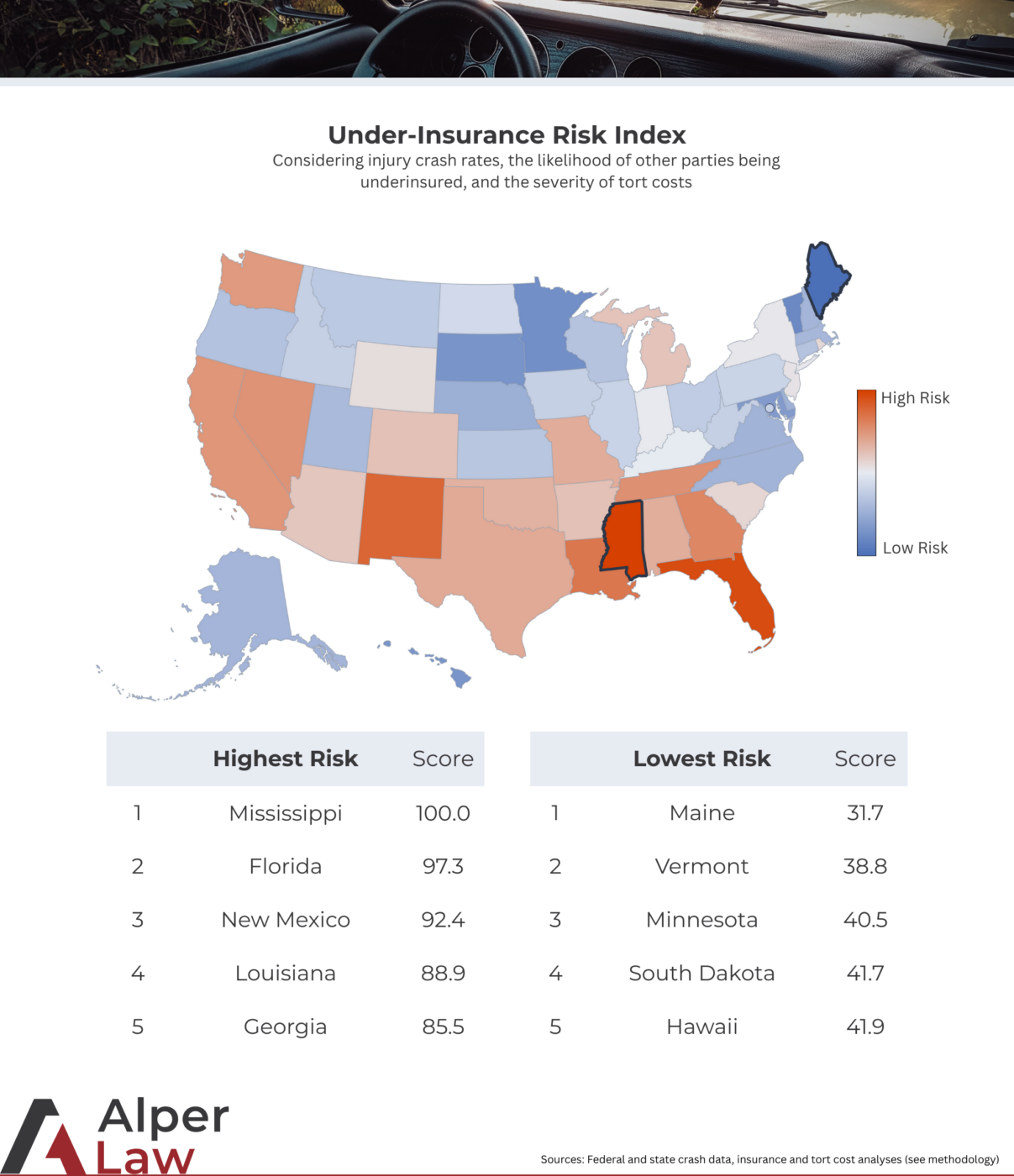

Overall Ranking

(See the data in full below)

Mississippi is the riskiest state to drive in without thorough insurance coverage, according to our index. It scored worst out of all states on both crash rates and insurance coverage, placing it in the top spot over Florida despite its comparatively low financial risk after a crash.

Florida ranks a close second, scoring poorly across the board, particularly in insurance coverage, resulting in an overall risk index of 97.3.

At the other end of the scale, Maine is the state where drivers face the lowest financial risk. Minimum insurance requirements are among the highest in the US, uninsured driver rates are among the lowest, and despite this strong coverage environment, the state scored fourth lowest in financial risk after a crash occurs.

Geographically, the data suggests that higher-risk states are concentrated largely in the southern half of the country, while lower-risk states tend to cluster in the north. All of the metrics analyzed contribute somewhat to this, but variations in state-by-state crash rates seem to be the main driver.

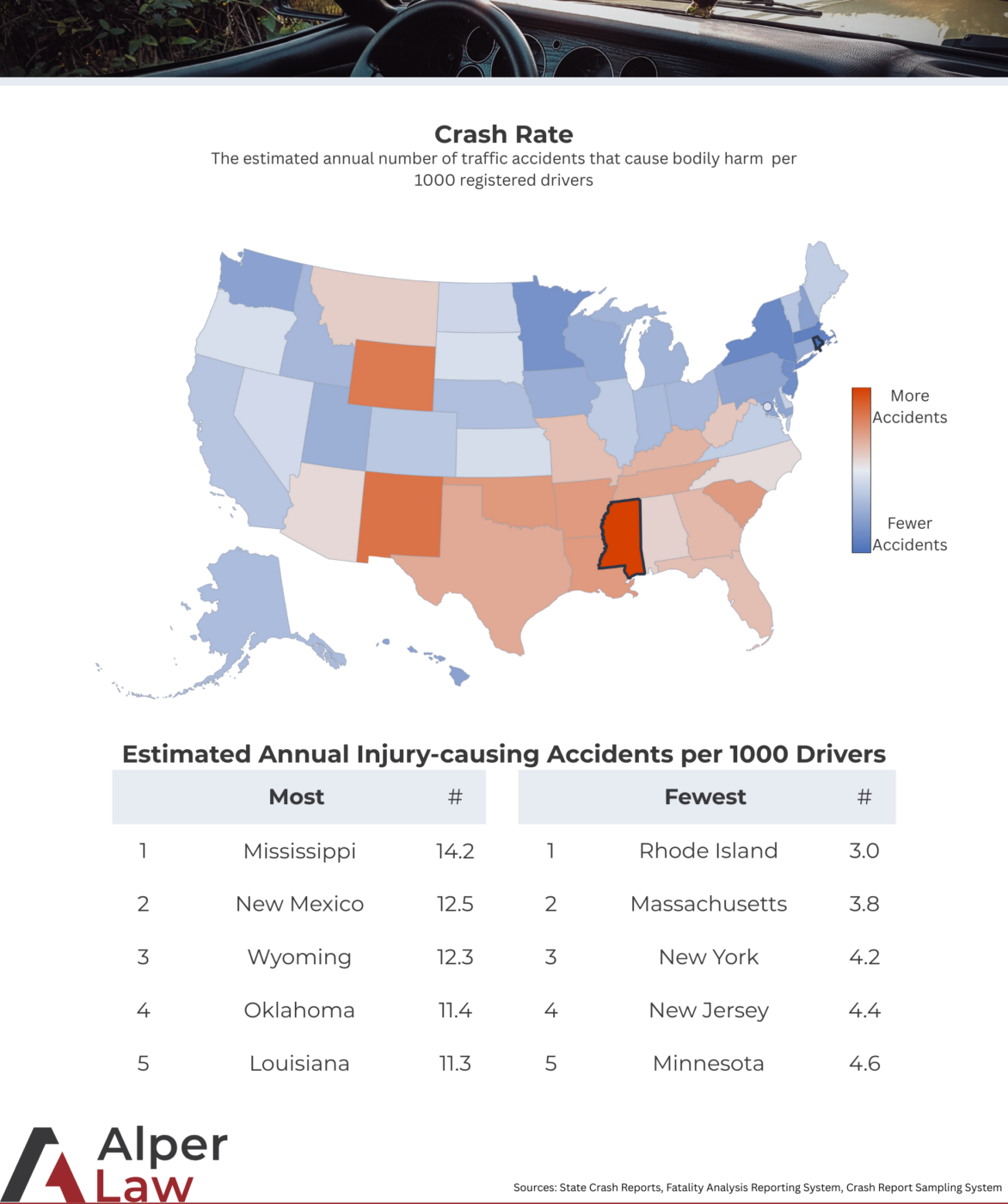

Dangerous Crashes per Registered Driver

Across the United States, an estimated 1.8 million motor crashes cause injury each year. However, a state having more accidents does not necessarily mean its drivers are less safe. To account for differences in population and measure relative safety more accurately, we compared the number of crashes with the number of registered drivers in each state.

At a national level, the 1.8 million annual injury-causing accidents and roughly 235 million registered drivers result in an average of 7.8 injury-causing crashes per 1,000 drivers each year.

In Mississippi, however, the rate is almost twice as high, at 14.2 injury-causing crashes per 1,000 drivers annually. This means that drivers in the state are twice as likely have a serious crash, and makes Mississippi the most dangerous place to drive in the USA.

At the other end of the scale, Rhode Island records the fewest serious crashes per driver, at less than half the national average rate.

Once an accident has occurred, insurance coverage becomes the next consideration for financial exposure for those involved.

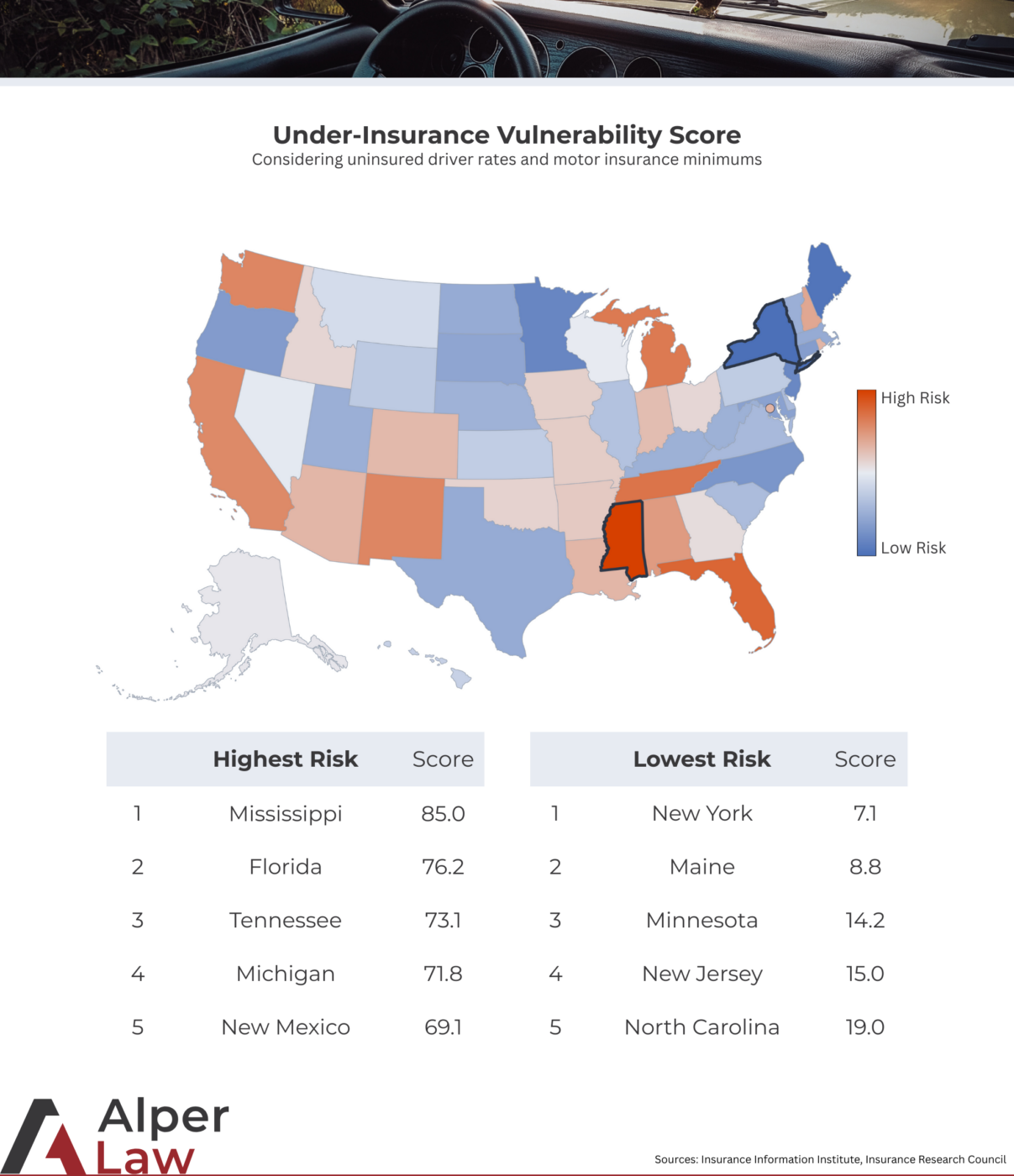

Insufficient Insurance

Almost every state requires drivers to purchase car insurance, though the level of coverage required varies dramatically. Even so, approximately 13% of people on the road in the USA are uninsured. However, even those who are insured up to their states’ minimum requirements are likely underinsured for any serious accidents. For example, across the 50 states and Washington, DC, only 20 jurisdictions require insurance against uninsured motorists, despite them accounting for more than 1 in 10 drivers nationally.

We compared uninsured driver rates and motor insurance minimums by state to find how vulnerable drivers are to being underinsured or being involved in an accident with someone who is underinsured.

Mississippi has the highest rate of uninsured drivers in the US at 29%, and yet the state is one of the 20 that does not require drivers to protect themselves from accidents with an uninsured driver. The state has a mandated $25,000 in bodily injury liability coverage per person, or $50,000 per accident, which is somewhat typical compared to other states but can easily prove insufficient in cases involving serious injury.

New York is the best-insured state, with the sixth-lowest rate of uninsured drivers at 4% and much wider minimum insurance requirements. It matches Mississippi on required Body Injury Liability coverage, but also requires protection against uninsured and underinsured drivers, as well as personal injury protection, which pays out on any injury regardless of fault.

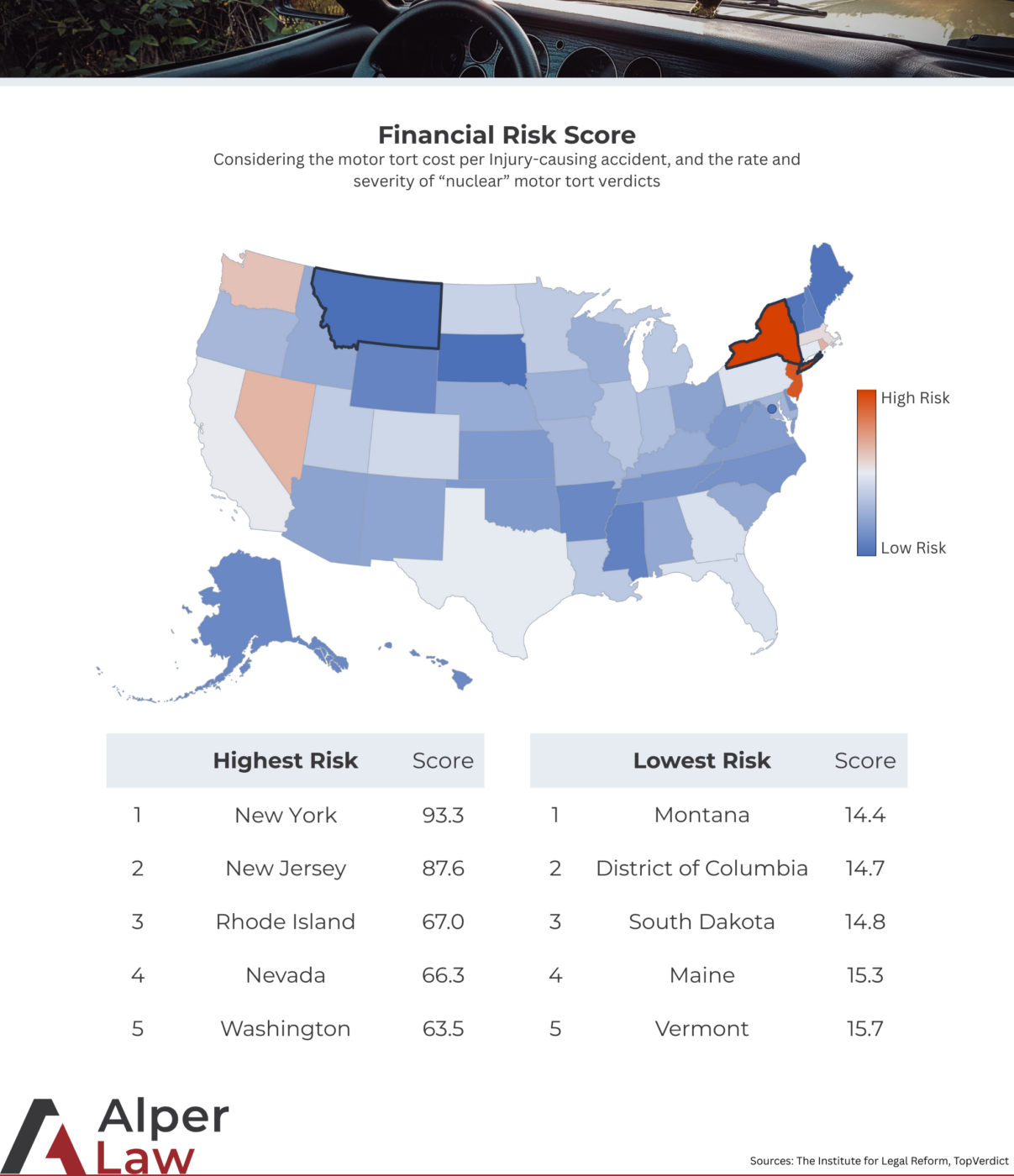

Financial Risk

Beyond accident rates and insurance coverage, differences in culture and in the legal systems also lead to varying levels of financial exposure after a crash has occurred. By analyzing tort costs and notable verdict sizes, we can compare this exposure.

New York and New Jersey have the highest financial risk scores by a significant margin, which may explain the lower uninsured driver rates and higher insurance minimums in the 2 states.

New York, in particular, takes the spot for the highest financial risk. Despite accounting for just 2.7% of injury-causing motor crashes nationwide, the state has been home to 11% of the largest motor vehicle accident verdicts in recent years.

Furthermore, in 2022, total motor tort costs in New York reached $12.9 billion. This equates to an average tort cost of more than $250,000 per injury-causing accident, the third-highest figure in the country.

Comparatively, the 5 lowest-risk states all have average tort costs per injury-causing accident in the $70,000-$80,000 range and have not produced any of the largest motor accident verdicts in recent years.

Mississippi, our most risk-prone state, scores well on this metric, placing seventh-lowest in financial risk. It has one of the lowest average tort costs per injury-causing crash at $59,000, but drivers there are not immune to financial risk. In 2019, the state was home to two massive motor-vehicle accident verdicts totaling $ 3.5 million and $ 4.2 million.

Conclusion

Driving risk in the United States is not evenly distributed, nor are the financial risks drivers face if an accident occurs. Depending on location, the likelihood of a crash can be several times higher, and the potential financial consequences can vary widely. When both the probability of an accident and the scale of possible damages are considered together, drivers can get a true sense of the risks they face on and off the road.

By combining these factors into a single index, this analysis showcases where insurance requirements, crash risk, and financial exposure fail to align. The results show that in higher-risk regions, meeting minimum insurance standards does not necessarily mean being adequately protected. In those states, serious accidents can quickly exceed policy limits, particularly when uninsured or underinsured drivers are involved.

Full Data

| State | Crashes/1k Drivers | Uninsured % | Tort Cost/Crash | Financial Risk | Vulnerability | Final Score |

|---|---|---|---|---|---|---|

| Mississippi | 14.2 | 29.40% | $58,732.77 | 20.1 | 85.0 | 100.0 |

| Florida | 10.1 | 20.40% | $137,006.80 | 50.2 | 76.2 | 97.3 |

| New Mexico | 12.5 | 21.80% | $66,395.31 | 31.4 | 69.1 | 92.4 |

| Louisiana | 11.3 | 11.70% | $111,241.10 | 42.4 | 58.0 | 88.9 |

| Georgia | 10.3 | 12.40% | $130,136.17 | 50.2 | 49.4 | 85.5 |

| Tennessee | 9.5 | 20.10% | $73,966.52 | 24.1 | 73.1 | 85.3 |

| Michigan | 5.8 | 19.60% | $85,264.48 | 34.0 | 71.8 | 77.7 |

| South Carolina | 10.5 | 10.90% | $113,101.44 | 38.2 | 46.5 | 76.9 |

| Oklahoma | 11.4 | 16.30% | $58,359.71 | 24.3 | 55.9 | 76.5 |

| Alabama | 9.5 | 19.50% | $63,640.73 | 20.4 | 61.9 | 75.9 |

| Kentucky | 9.5 | 13.90% | $78,589.65 | 27.1 | 51.8 | 72.4 |

| Nevada | 6.6 | 10.40% | $170,067.89 | 66.3 | 38.6 | 71.2 |

| Arkansas | 9.6 | 10.30% | $72,895.83 | 21.8 | 47.2 | 68.9 |

| Texas | 8.3 | 12.00% | $89,481.98 | 33.5 | 41.9 | 68.6 |

| Arizona | 7.5 | 11.80% | $104,675.24 | 37.3 | 41.7 | 68.4 |

| Missouri | 8.9 | 13.90% | $66,687.97 | 22.1 | 44.7 | 67.8 |

| New York | 4.2 | 4.10% | $237,580.46 | 93.3 | 7.1 | 65.8 |

| New Jersey | 4.4 | 3.10% | $222,237.91 | 87.6 | 15.0 | 65.6 |

| Maryland | 7.4 | 14.10% | $67,807.56 | 23.3 | 44.9 | 63.1 |

| Delaware | 8.4 | 11.40% | $74,765.17 | 25.4 | 39.1 | 62.8 |

| California | 7.1 | 16.60% | $61,280.40 | 21.3 | 47.3 | 62.4 |

| North Carolina | 8.8 | 7.40% | $75,727.60 | 24.5 | 19.0 | 60.8 |

| Colorado | 6.6 | 16.30% | $61,819.34 | 22.1 | 39.0 | 59.3 |

| Oregon | 7.6 | 10.70% | $68,427.65 | 22.7 | 31.0 | 59.1 |

| Washington | 5.9 | 10.30% | $162,266.30 | 63.5 | 30.5 | 58.3 |

| Illinois | 5.8 | 11.80% | $88,514.81 | 31.7 | 34.0 | 56.6 |

| West Virginia | 7.5 | 9.20% | $59,336.56 | 19.6 | 35.7 | 56.4 |

| Virginia | 6.4 | 10.50% | $73,004.93 | 24.3 | 30.8 | 54.1 |

| Indiana | 7.1 | 14.80% | $49,596.34 | 17.4 | 37.2 | 53.8 |

| Kansas | 6.7 | 10.90% | $53,232.88 | 18.0 | 31.2 | 51.8 |

| DC | 8.6 | 12.10% | $45,654.81 | 14.7 | 42.4 | 51.1 |

| Pennsylvania | 5.6 | 6.00% | $123,730.00 | 43.2 | 19.9 | 50.7 |

| Rhode Island | 3.0 | 16.50% | $171,440.06 | 67.0 | 38.8 | 49.8 |

| Alaska | 6.0 | 15.40% | $46,765.26 | 16.4 | 37.9 | 49.2 |

| Ohio | 6.1 | 13.00% | $47,458.74 | 16.8 | 35.0 | 49.1 |

| Iowa | 6.1 | 11.30% | $50,624.59 | 17.5 | 31.7 | 48.5 |

| Utah | 7.4 | 8.20% | $47,468.10 | 16.7 | 26.5 | 48.4 |

| Nebraska | 7.7 | 9.30% | $43,405.67 | 16.0 | 27.8 | 48.2 |

| Connecticut | 5.7 | 6.30% | $98,380.59 | 33.5 | 23.3 | 47.5 |

| Wisconsin | 5.2 | 13.30% | $48,259.07 | 17.4 | 35.4 | 46.5 |

| Montana | 6.9 | 8.50% | $40,134.19 | 14.4 | 26.9 | 45.8 |

| Wyoming | 12.3 | 5.80% | $42,211.75 | 15.9 | 23.1 | 45.7 |

| New Hampshire | 5.5 | 6.10% | $60,897.46 | 21.5 | 19.4 | 43.6 |

| Idaho | 6.0 | 9.30% | $42,981.16 | 16.1 | 27.8 | 43.4 |

| Massachusetts | 3.8 | 3.50% | $122,606.33 | 46.4 | 19.5 | 43.2 |

| Hawaii | 5.8 | 9.30% | $46,808.64 | 17.4 | 41.9 | 41.9 |

| South Dakota | 7.2 | 7.40% | $41,180.20 | 14.8 | 41.7 | 41.7 |

| Minnesota | 4.6 | 10.80% | $43,482.72 | 16.2 | 14.2 | 40.5 |

| Vermont | 5.3 | 8.80% | $43,485.64 | 15.7 | 38.8 | 38.8 |

| Maine | 4.9 | 4.90% | $41,620.40 | 15.3 | 8.8 | 31.7 |

Methodology

Crash rates

State-level fatal and injury crash data were collected from 2022 state crash reports, or equivalent, where available. Fatal crash data for all states were also obtained from the National Highway Traffic Safety Administration’s Fatality Analysis Reporting System (FARS). National data on injury-causing crashes were sourced from the Crash Report Sampling System (CRSS).

Using the states where both fatal and injury crash data were available, we calculated an average fatal-to-injury crash ratio of approximately 1:44.15. This figure aligned with the national ratio implied by CRSS data. We therefore applied this ratio to FARS fatal-crash figures to estimate the total number of injury-causing crashes in each state for which official state publications could not be found.

For the purposes of this analysis, crashes causing fatal or non-fatal injuries are collectively referred to as “injury-causing crashes.”

Crash risk was normalized by comparing injury-causing crashes to the number of registered drivers in each state.

Tort costs

State-level total motor tort costs were sourced from the U.S. Tort Cost Trends report published by the Institute for Legal Reform (ILR). These totals were used to estimate average tort costs per injury-causing motor crash at the state level.

Extreme verdicts

Data on the largest motor vehicle verdicts and settlements was sourced from TopVerdict from 2019 to 2025. States were assessed based on both the frequency of top verdict appearances relative to crash volume and the typical size of extreme verdicts.

Insurance requirements and underinsurance

Minimum motor insurance requirements by state were sourced from the Insurance Information Institute (III). Each state was assigned a minimum coverage score based on required bodily injury liability limits, uninsured and underinsured motorist coverage, personal injury protection (PIP), and financial responsibility laws.

Uninsured driver rates were sourced from the Insurance Research Group’s analysis of uninsured motorist statistics.

Index construction and weighting

Three-component scores were calculated for each state:

- Crash risk score

- Based entirely on the number of injury-causing crashes per 1,000 registered drivers.

- Financial risk score

- 50%: average tort cost per injury-causing crash

- 30%: number of TopVerdict appearances per 1,000 crashes

- 20%: logarithmic mean size of TopVerdict verdicts

- Underinsurance vulnerability score

- minimum insurance requirements score (50%)

- uninsured driver rate (50%)

The final Under-Insurance Risk Index combines these components using the following weights:

- 40% Financial risk

- 30% Crash risk

- 30% Underinsurance vulnerability

Sign up for the latest information.

Get regular updates from our blog, where we discuss asset protection techniques and answer common questions.

Please enable JavaScript in your browser to submit the form

Publisher: Source link