So, you’ve decided that you need a budget and this is the year you’ll finally tackle your finances! You’ve signed up for YNAB’s free 34-day trial, then cracked open the app to get started on your shiny new personal budget. That’s when it hit you: this new YNAB budgeting system seems a little…well…different. And now you have new budgeting questions, too.

We don’t budget to the same beat as the other guys. But those differences? They’re exactly why YNAB works so well—and why hundreds of thousands of people have finally gained control over their money.

YNABers who stick with it go on to achieve amazing feats (like retiring without fear, turning their financial lives around, and even quitting smoking). Heck, after just one month with YNAB, one guy had money in his savings account for the first time in a decade. YNAB isn’t a typical budget plan, and that’s why the potential to meet your financial goals is extraordinary.

Of course, because we’re different, the budgeting process takes some getting used to. It’s kind of like that nerdy kid in high school that ends up becoming your best friend. We’ve seen where new budgeters get stuck and frustrated, and we want to help you avoid the same.

Keep reading for answers to ten of the most commonly asked budgeting questions that new YNABers send us as they start to prepare a budget.

Budgeting Questions From New YNABers

1. How Do I Start YNAB?

The first step toward long term financial control is deciding that you need to create a budget (great work!). But how do you actually get started in YNAB? It can feel a little overwhelming to face your personal finance situation or to learn a new app, so juggling both at the same time is bound to feel challenging.

It’s a lot to take in all at once, so it’s no wonder that you’ve got budgeting questions. We’ve got a ton of resources to help you get started, all depending on your learning style:

- If you learn by watching YouTube videos: watch this video. Learn everything you need to know on your time. You’ll learn the YNAB method, plus how to start and use your YNAB budget.

- If you like to work with a real, live person: join a free workshop. Sign up for one (or 10) of our live workshops. They’re short, jam-packed with useful information, and our amazing teachers always have answers for your specific budgeting questions.

- If you learn by reading: Check out our Ultimate Getting Started Guide. When you’ve digested that novella, read up on our breakdown of the Four Rules.

2. How Do I Enter My Income?

If you’re scratching your head and trying to figure out how to plan your monthly budget, or wondering how you enter the amount of money you take home for the month, the following should help:

YNAB Doesn’t Use Forecasting

YNAB helps you budget the dollars that you have right now—we’re very intentional about that. A lot of new YNABers want to plan out their entire month, budgeting all of the dollars that they plan to receive within that month. In other words, they want to forecast.

The problem with forecasting is that it eliminates scarcity because you can cover all of your bills and expenses with future money—money you don’t yet have—and speculation like that can really get you into trouble. Sure, you might guess correctly that you’ll get a paycheck on your usual payday, but what if you don’t?!

YNAB’s method is about allocation, which means assigning the dollars that you have in your bank account (right now!) to the jobs you’d like them to perform, in order of priority or importance. It’s called zero-based budgeting, and although it’s a big shift from traditional forecasted budgeting, it can change the way that you think about money management.

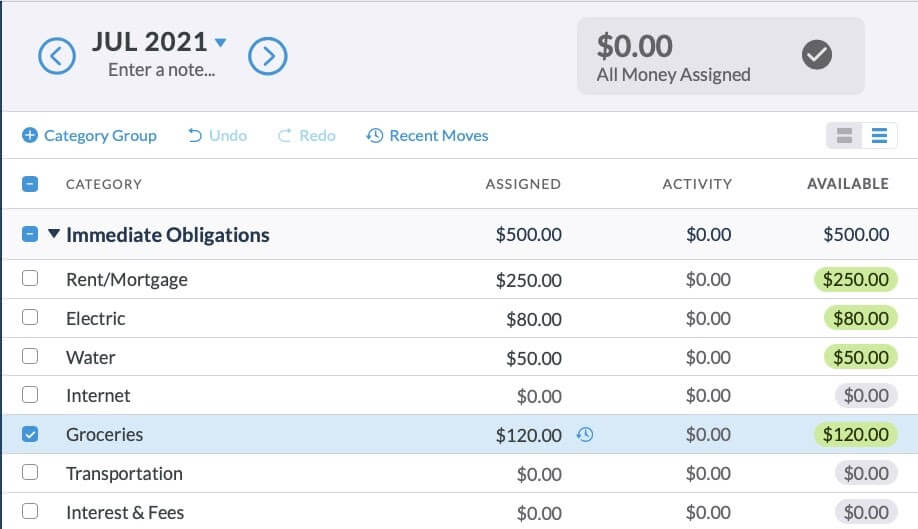

Practically speaking, this means that if you only have $500 in your bank account, you can only budget $500 in YNAB. You’ll have to wait until you receive more income to budget more dollars.

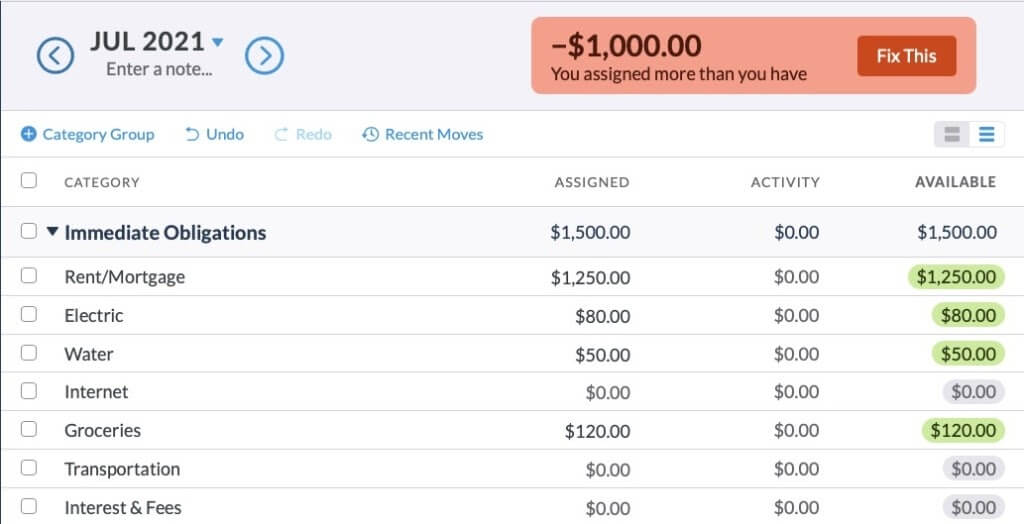

If you try to budget more than $500, your “Ready to Assign” number in YNAB will turn red, like this:

To get out of the red, you have to prioritize. If the electric bill, water bill and groceries are non-negotiables, then you can only budget $250 towards the rent until you get paid again. This gives you a much clearer picture of the scarcity of your cash, and helps align your spending with your priorities.

You Can Still Plan Ahead!

So, if you can’t forecast, then how do you plan for an entire month, you wonder? Isn’t this budgeting thing supposed to help you anticipate upcoming expenses and plan accordingly? Why, yes, it will! You just need a budget template and some savings targets.

3. Do I Have to Wait for Payday to Start My Budget?

You don’t need to wait until payday to start budgeting (and no need to feel left out if you’re not paid monthly). YNAB works for every pay cycle (weekly, bimonthly, monthly, quarterly and even variable income), and it works whenever you’re ready to start—and, it works especially well once you do!All you have to do is budget the dollars that you have right now. It doesn’t matter if you have two dollars or two thousand dollars, your mission is to allocate all of that cash to the most important, most urgent jobs in your budget. When you get paid again, you’ll budget, again. It’s financial planning at its finest!

4. What Happens When It’s a New Month?

One day, probably more than one day, but less than 32 days after you start (okay, definitely less, definitely), the month is going to “roll over.” And, with the new month, you’ll notice a few changes in your budget:

Your Overspending Disappears

If you overspent in cash, the previous month’s category balance will display in red, but the current month will show a balance of zero. So, what happened? YNAB automatically deducts the amount that you overspent from “Ready to Assign” in the new month.

If you overspent in credit, the previous month’s category balance will display in orange, and the amount that you overspent will be added to your credit card balance. If you can’t cover the overspending in the same month that it occurs, you’ll need to budget directly to the Credit Card Payments category to pay back the credit card debt.

Assigned Amounts Disappear

With the new month, all of your assigned amounts will be empty. In other words, it’s time to budget, and there are a few ways that you can tackle it:

- Go category by category, working down your list of priorities and using the Inspector as your Guide. When you get to $0.00 in “Ready to Assign,” stop!

- Use the “Underfunded” option in Auto-Assign to budget one category, or category group, at a time.

- Use the “Assigned Last Month” option in Auto-Assign to fill in this month’s budget with the same amounts that you budgeted last month. Then, adjust as necessary for the current month.

- And, when you’ve got more history—at least four months or so of YNAB experience—try out “Average Assigned” or “Average Spent” in Auto-Assign. These options rely on data that ties back to your actual spending habits.

You’ll also see that any positive amounts (aka extra money!) left in your categories from the previous month will be sitting there, just where you left them.

5. Why Doesn’t My Budget Match My Bank Balance?

On the left-hand side of the screen in the YNAB web app, you can see your account balances. The first thing you should do when you open your budget is make sure that those balances match your bank account. Using the example budget, below, you’d want to log into your Acme Bank account and confirm that your balance is $500.

.png)

If your bank balance doesn’t match the account balance you see in YNAB, it’s time to reconcile.

Reconciliation is simply the process of entering all of your bank transactions into YNAB so that your budget knows how much money is in your bank account. If you try to budget without reconciling, you’re working with incorrect data and your budget won’t be right!

Imagine that you have $500 in the bank, but you see $600 in your YNAB account balance. If you are in the habit of reconciling before you budget, you’ll spot the $100 transaction that’s missing from YNAB and correct it. If you don’t, you’d budget $600 and potentially overdraft your account!

For a detailed explanation of how to reconcile, check out this help doc to learn how to reconcile.

6. Direct Import Isn’t Working. Now What?

Direct Import helps make sure you have all your transactions in YNAB. Transactions import once they clear your bank (which can take a day or two), so it’s best to record your spending right away. When transactions are imported, they’ll match right up with the ones you entered (without creating duplicates)—and you’ll know you haven’t missed any.

Direct Import is amazing, but there are quite a few moving parts, and sometimes the process needs a little troubleshooting. If you’re having issues establishing a connection with your bank, transactions aren’t importing, your connection stops working or your financial institution isn’t listed in YNAB, check out this handy guide.And don’t forget, whether you’re using Direct Import or not, you can enter transactions into YNAB yourself! That’s right, it’s totally OK to enter your transactions manually. In fact, some of us prefer it or even do both! (Here’s why some of us do both: we enter transactions manually to bring awareness to our spending and then pull in the direct import as an assurance we didn’t miss anything. Best of both worlds!).

7. What’s with YNAB’s Credit Card Payment Category?

When you spend money on a credit card, you create debt. Whether you buy a $35 shirt or a $0.35 pack of gum, you owe that money to the credit card company. The important thing is that you reserve some of your money to pay off that debt (because we hate debt!), and that is what your YNAB budget is designed to do.

For an overview of how credit cards work in YNAB, read this.

About Credit Card Payments

- To budget money for your credit card payment to reduce your starting debt, you need to allocate dollars to the “Credit Card Payments” category. This amount will display in green in the “Payment” column of your budget.

- A red payment amount means that you paid more to your card than you budgeted for.

- If you made a budgeted purchase—in other words, you planned to spend the money—and you use your credit card as payment, the money will be subtracted from the appropriate category in your budget and added to your credit card payment category. For example, if you buy $30 of groceries on your card, you’ll see a $30 drop from your grocery budget and a $30 increase in your credit card payment category. This way, you can pay off the card in the same month that you bought the groceries, avoiding debt and interest!

8. How Do I Categorize a Credit Card Refund?

Scenario 1

Let’s say that you charge $100 for clothing on December 5th, but then you decide that swoveralls just aren’t your jam, so you return your purchase. When you enter your refund into YNAB, record it as an inflow to your credit card account, and categorize the transaction based on the appropriate budget category. In this case, your clothing category.

This causes the following: $100 is added to your clothing category, and $100 is removed from your Credit Card Payments category. Done!

…but, wait, there’s more!

Scenario 2

Let’s say that, after you charged $100 for clothing on December 5th, you pay your card in full on the 21st. You don’t realize that swoveralls aren’t the new hotness until January (Egads, you’ve already made the credit card payment!). That $100 refund will show up, in red, under your credit card category. Why’s that, you ask?

It feels a little counterintuitive, but the red number indicates that you have a $100 credit on your card. (Remember, if you budget for your credit card payment, that figure is green. The green number is the amount you will pay your credit card this month. Red is the opposite.)

So, how can you avoid this confusing red number? When you record your refund in the credit account screen, categorize it based on the purchase—in this case, you’d put it under your clothing category. Don’t need money for clothes, right now? Then move the $100 to whatever category you like!

9. What About My Savings?

Per Rule One, every dollar gets a job—and that includes your savings! It doesn’t matter if that job happens this month or in twenty years. Create a category in your budget for whatever your intentions or savings goals may be (e.g., job loss, vacation next year, an emergency fund, a new bike, etc.). Here’s how to assign your savings. Doing this will help you save money, so don’t skip this step!

10. What’s This “Age of Money” Thing?

Rule Four, Age Your Money, seems pretty straightforward—hang onto your cash as long as you can before you spend it (Watch the Rule 4 video here to learn about aging your money). The longer you have the money in your bank account, the older it becomes. It’s a great financial situation to be in, too, because, when you don’t need to spend new income right away, you’re able to budget those dollars into the future.

When you first start budgeting, you won’t have an Age of Money number. That’s because you don’t have enough activity in YNAB, yet, for an accurate calculation. Give it a little time.

How Is Age of Money Calculated?

Let’s say that you start budgeting today. Let’s pretend that you put all of your current money into a bucket with the label “Bucket #1.”

Now, imagine that payday is tomorrow. You put that money into Bucket #2. Your partner gets paid this Friday, and boom! You’ve got Bucket #3. Next week, your grandma sends you a birthday card with a cash gift. Yup, that’s Bucket #4. Every time you get more money, you add a new bucket.

When it’s time to pay a bill or refill your gas tank, you dip into your buckets, in order, starting with Bucket #1. When a transaction pulls funds from more than one bucket (e.g., it finishes one bucket and starts taking from the next), the age is a weighted average of how old those buckets were.

Every time you spend, your Age of Money is recalculated based on the average of your last ten cash transactions. And that’s the number that appears just above your budget. The older it grows, the less you’ll worry about when payday arrives.

More Budgeting FAQs?

Between our Getting Started Bootcamp, live workshops, and endlessly helpful support, we are here for all of your budgeting questions.

Wishing you the best in this budgeting journey. Give that mirror a good bicep flex because here you are, gaining total control over your money.

Publisher: Source link