Have you ever worried about money? You’re not alone, especially when it comes to the realities of retirement. Most of us live with that looming question: “How will I live when the paychecks stop?”

The answer, or so we’ve been told, is to save, save, save! Most of us spend our whole lives believing that working more and saving more is the only path to a secure retirement.

But here’s a secret: when you’re good with money, retirement is more about spending than saving.

It comes as no surprise that switching from a savings mindset to spending mode when it actually comes time to retire can feel absolutely terrifying. Making that shift isn’t as simple as waking up one day and deciding you’re ready to start spending. There’s no shortage of education on how to save, but no one ever teaches us how to spend with confidence once the paychecks stop rolling in.

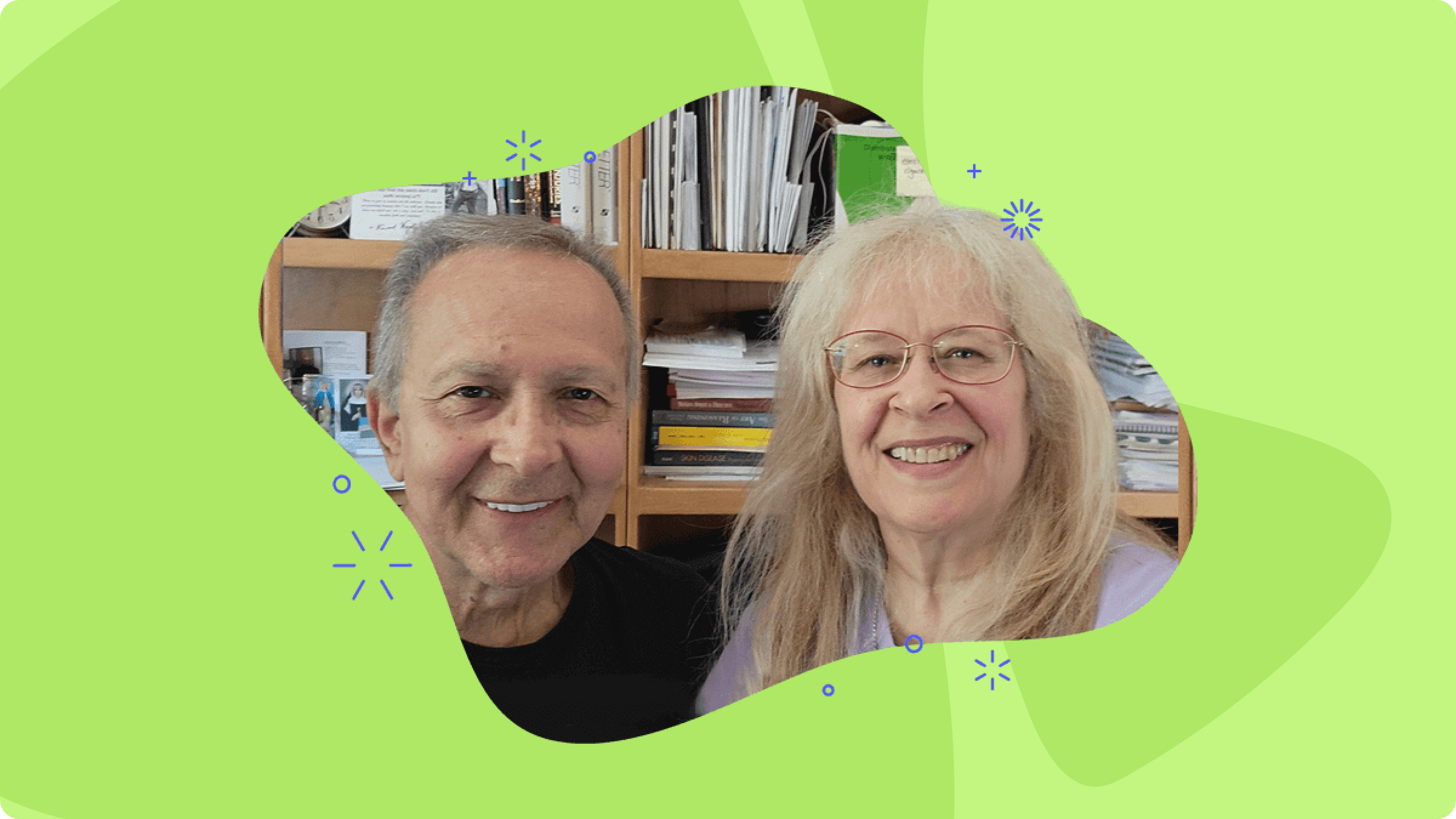

Recently, a YNABer named Frances shared her story with us through our YNAB stories survey—and this one is particularly special. Her honesty, vulnerability, and clarity about how her relationship with money transformed in retirement moved me deeply. And I think her story is super relatable to those nearing that particular life transition.

So today, I’d like to share Frances’s story, told mostly in her own words, about what happened when retirement came earlier than she planned. Fear crept in, and she suddenly realized that spending felt far scarier than saving ever had.

But then came the plot twist. YNAB helped her uncover a skill she didn’t even know she was missing.

.png)

When life shifted suddenly

Frances is a 64-year-old grandmother, homemaker, and—as she puts it—an avocational singer. Belt it, girl!

She and her husband had a plan: he would retire in about three years, after their mortgage was paid off and after a few final years of higher earnings once their kids finished college.

Then everything changed.

Our plans changed drastically when my husband was diagnosed with stage 4 metastatic prostate cancer, a rare, aggressive, hereditary form that had just taken his brother’s life the week after my husband was diagnosed.

Devastating doesn’t even begin to describe it. And while this news brought heaps of stress around doctors and treatment, finances were not far from Frances’s mind either. That diagnosis meant her husband needed to retire immediately, three years sooner than they had carefully planned. That’s when the fear rushed in.

Seeing this coming, I was in a panic about our finances. We have enjoyed a life with a high level of discretionary spending—or so I thought—and making the adjustment to retirement where we were prematurely not going to have the amounts we had planned for was frightening for us.

Realizing no one ever taught us how to spend

Frances describes their pre-retirement life as comfortable. They had good income and no debt, and they “covered their misdeeds,” as she puts it, with high earnings. But, because they never actually tracked their spending, Frances felt like she was in the dark.

For a couple of years, I tried to figure out exactly how much we had been spending. I would sit down for a few weeks and go over six months of spending and try to categorize all of it on paper. I would get tired of this as I saw with despair how much we had been spending and couldn’t see a way out… We would just keep living the same way.

Like so many people approaching retirement, they had saved but had no idea how much they spent. So they had no idea how to pace their resources and every purchase felt terrifying.

All this made Frances feel like she was bad with money. But it wasn’t a character flaw. She was simply missing a skill most retirees never learn: intentional spending.

Seeing money clearly for the first time

When her husband’s sudden retirement became inevitable, Frances finally decided to try YNAB.

I said to myself, “Let me plunge in and just do this YNAB thing without knowing what I’m doing.”

Within weeks, everything changed.

YNAB did for me what all those hours of tracking had never been able to accomplish. It helped me understand and see the picture of our money and how we use it.

She used YNAB for day-to-day spending and then used what she learned to build long-term retirement projections. It was amazing how quickly everything started to make sense and the fear started to subside.

Seeing the whole picture—not the guesses, not the fears—gave her a sense of calm for the first time in years.

The breakthrough moment: all money is going to be spent someday

Now it’s time for my favorite part of Frances’ story. This is the “aha” moment that changed everything for her.

Frances and her husband had a substantial savings account earmarked for retirement. At first, she left it sitting there under one big category (simply called “Savings”) but something felt off.

One day, this thought hit me: What if I had been using YNAB for many years already? What if this big pile of cash in our savings had been the result of putting aside a little for various spending goals month to month and had accumulated over time? What savings goals would I have made for these funds?

That’s when she realized: at this point in her life, money isn’t meant to sit untouched. It’s meant to be spent—on purpose.

She had spent nearly a lifetime accumulating money without any tangible goals on what to do with it. A big pile of cash should have at least provided her with security, right? But it didn’t make her feel like she’d be okay, because she hadn’t learned how to count the costs of retirement and see clearly that she was going to be okay.

Once she realized this money was meant to be spent, she started dreaming for the first time. She started actually giving those dollars jobs. And those jobs were very specific. She started setting money aside for so many awesome things. Well, I’ll just let Frances tell you:

So, I started making categories. “Visiting Grandchildren,” “New Car in 2035,” “Big Trip Number 1, Big Trip Number 2, Big Trip Number 3,” “Florida Winter 1, Florida Winter 2, Florida Winter 3,” “Caregivers at the end,” etc …”Keeping up with Technology,” “1-bedroom Condo in Florida.” I stuffed those categories with cash until every last dollar in ‘Savings’ had been given new jobs.

And then she told her husband something extraordinary:

I told my husband, “We’re going to spend this money, and here’s how we’re going to spend it”. Instead of just having this bunch of “savings,” we now have planned how we are going to spend the dollars.

That’s what it means to be good with money: knowing exactly where your money goes (wherever you tell it to!).

Frances felt secure, and she was leading her husband to that sense of security, too. And what’s so wild is it’s not like Frances suddenly got a windfall of money. She had it all along after a lifetime of diligent saving. Just the simple act of giving those dollars real jobs made her feel okay. Actually, she felt more than okay. She felt excited about her retirement life for the first time!

.png)

Spending without fear

The confidence Frances describes here is beautiful:

Knowing that we can spend without fear has been tremendous… Whenever my husband gets scared about being retired, I can show him how I’ve financed months in advance. We are covered through the next two months, and then we have this and this and this.

When I read that, my first thought was “What are all these “this’s” she’s talking about? And then she shared a perfect everyday example:

The other day he was turning the air conditioning off to ‘save money,’ and I told him it was already covered. If he wanted to repurpose that money, he could—but what did he want? More fun money? He has plenty of that. More going out to eat money? We have enough. More money to buy presents for grand kids? Got it covered.

Instead of reacting out of fear, they now make choices out of clarity. She goes on:

Save the money in case something goes wrong in the future? Why don’t we cross that bridge when we come to it? Since we are giving jobs to the dollars we already have, we’ll do that in the future too—even if there are fewer dollars someday. We can cut off the A/C then.

What I love about this example is how boring it is! Frances’s husband wasn’t worried about the big trips or end-of-life care as much as he worried about simple utility costs. And those kinds of money worries carry a special kind of pernicious stress.

For Frances and her husband, planning their retirement spending meant feeling calm about all the little things in life we spend money on—yes, even the air conditioning.

And this feeling of security came from more than having money set aside for specific expenses. Frances felt secure in the skills she had built for herself in her retirement years. Let the unexpected come, she knows she can handle it when it does. What can take away her fear now?

Learning that spending can actually feel good

Much of this fear comes from how Frances grew up. Her parents had taught Frances extreme frugality. But what seemed like a virtue caused Frances to believe that spending was something to fear.

The message I got through my upbringing was that spending was bad, maybe even actually evil. YNAB gave me an alternative where it said that spending was okay. YNAB showed me that my objective was to spend my money, and that the reason I was managing it this way was so that I could spend it.

She realized their retirement savings weren’t something to clutch tightly. They were meant for the life they wanted.

These savings we had ‘for retirement’ were not for some vague unexpressed thing, but could be used for specific purposes that could bring joy.

This is the heart of her transformation. Spending became an expression of her values, not a source of fear.

Feeling empowered to choose the life they wanted

Spending intentionally showed Frances she had the power to design her life exactly how she wanted it. For years, financial advisors told them they might need to sell their home in order to live comfortably. But once Frances saw their money clearly, she realized something different:

We began to see that it was possible to continue living in our house. We had been depressed thinking we had to sell, and when the realization dawned on us, it reinvigorated us on many levels.

Rather than feeling like a victim of circumstances, Frances began to see the power of tradeoffs:

We could trade off our house for a lot more spending power. Understanding this tradeoff dynamic helped us feel less powerless because we saw that we weren’t actually being deprived of something we wanted but were making a choice of one thing for another.

That’s real empowerment: not unlimited resources, but the clarity to choose exactly what you want most.

How this financial shift led to a stronger relationship

One of my favorite parts of Frances’s story is what happened in her marriage. There’s something so beautiful about a life-long relationship changing for the better late in life. And this bit of her story made a huge impact on me:

My husband was a little unwilling to let me into the financial aspect of our lives together because of my spending personality… My husband feared that if I saw our assets and income all together, that I would spend even more, so he was reluctant to let me into the whole picture.

When Frances did take over the finances, what happened shocked them both. It turned out the opposite was true.

Little did he know that letting me see the whole picture would help the problem, not make it worse, because I’m very mathematically and practically minded. I am not the kind of person who, once I saw the picture, would want to undermine us. I would be for our success.

Frances was the first to admit that she often struggled with impulsive spending. Her husband thought the solution was to hide the full financial picture from her. But the opposite was true!

Then, Frances shared this delightful discovery:

I found that giving every dollar a job completely fulfilled the part of me that got satisfaction spending money. I got the same pleasurable spike that I experienced when I spent money when I took the money from “ready to assign” and gave it jobs. It was amazing, actually, because I could have all of the pleasure of spending, but none of the costs

Isn’t that amazing? I can totally relate to Frances here. In fact, she gave words to a feeling I’ve often experienced. Giving every dollar a job in YNAB is so satisfying because it feels like you’re spending it before you actually spend it, and that’s really fun! Frances found it so much easier to save, because she knew ultimately the goal was to spend the money in a way that lined up with who she was.

That spending problem she had worried about her whole life? It was a thing of the past.

I was able to completely solve my spending problem, because I could see how each spending choice tied into the whole financial picture.

Her husband now trusts Frances fully with their finances, and they find it so much easier to talk about money as a result:

We have wonderful talks about our spending and categories all day—although sometimes he says I talk about it TOO much, LOL.

What a happy transition Frances and her husband have gone through in their retirement years. Their partnership is blossoming in a whole new way. Practicing the YNAB method has built more trust between the two of them than ever before.

.png)

By the way, if you want to get on the same page with your partner about your finances, there’s no better way than to use YNAB Together. You can reach your goals and share a subscription for the cost of one.

Spending on what matters most

For Frances, one category represents her heart more than any other:

My “Visiting Family” category represented my values the most. Time and time again when I have to find funds for overspending, I don’t want to touch that category, because being able to see our children, grandchildren, and our sisters and parents on a regular basis is extremely important for us.

Their biggest dreams are still ahead:

- Stay in their home

- Buy a small condo in Florida for winter months

- Spend richly on family, connection, and joy

And now, those dreams feel real for the first time. Fear has been replaced with possibilities.

A new skill that means we have more of Frances in the world

Frances didn’t have to change who she was to stop worrying about her money. She just needed to learn a skill she never knew she needed: the skill of spending with purpose.

She discovered that preparing for unexpected expenses and sending her money to the things she loves, led to a more prosperous life. Her future is more secure, more exciting, more her! She got good with money, really good!

With that skill came something priceless:

The biggest win was peace of mind and feeling in control of our choices. We can find ways to have things the way we want if we are willing to make the choices consciously and purposefully.

For Frances, spending in retirement no longer feels scary. It feels intentional. It feels like living.

If spending your hard-earned retirement savings has you worried, you’re not alone. And it’s not too late! Get YNAB, get good with money, and never worry about money again. Try YNAB free for 34 days.

Publisher: Source link