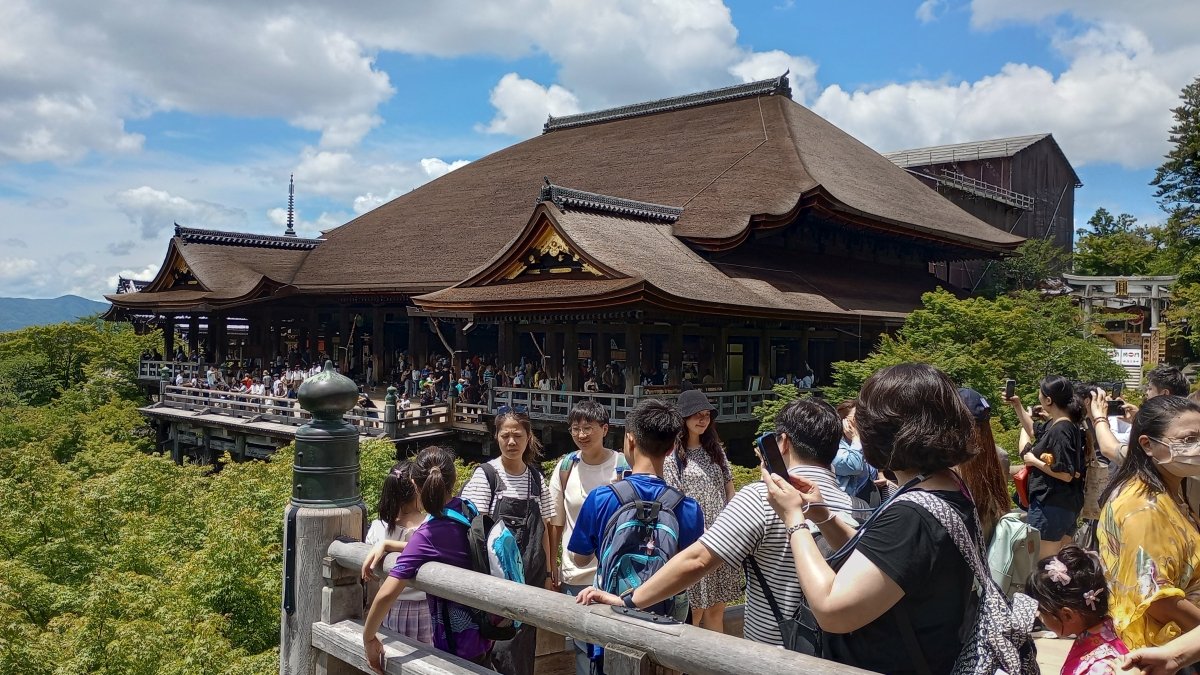

Hey Everyone! This FIRE update will be a short one because I’m on vacation in Japan. We are exhausted from walking around so much every day. Fortunately, I got us a room at the Dormy Inn. This hotel has an onsen facility (hot spring), massage chairs, free popsicles, yogurt drink, and ramen. It’s my favorite business hotel ever. A soak in the hot springs after a long day of walking helps a lot. Japan is great. We love it here. The public transportation is awesome. The food is delicious and eating out is cheaper than in US. This trip is very different from the last time we visited in 2010. Back then, everything felt expensive. Today, I think Japan is a great deal. The strong dollar makes a big difference. I’ll write more about our trip next time.

On the personal finance side, we had a good month. Our net worth reached an all-time high due to the stock market. The stock market pulled back a bit at the end of June, but we still came out ahead. Our cash flow wasn’t good, though. We are spending a lot of money on this vacation… I’ll put off the cash flow until next month. I’m having too much fun to work on the cash flow spreadsheet. Our net worth looks good so I’m not worried.

Alright, I’ll share how I’m doing with my New Year goals. Then, I’ll go over our net worth.

2024 Goals

Here is my 2024 goal spreadsheet. It works well. Try it out if you can’t keep up with your New Year goals. The key is to review the spreadsheet monthly to track your progress. That way, you can see which goals need extra attention and work on them. Time is running out!

Financial Goals

FI ratio > 100%

The FI ratio is passive income divided by expense. If you can generate enough passive income to cover your expenses, then you’re set. For 2024, I reduced this goal to 100%. We are getting older and feel we can spend a bit more. Last month, our FI ratio was 123%. I need to update the number when I get home. It’s too difficult to do while we’re on vacation.

*FI Ratio = passive income / expense

3% Rule

Everyone is familiar with the 4% retirement withdrawal rule, right? Basically, you should have a successful retirement if you withdraw less than 4% of your investable assets annually. Let’s see if we can spend less than 3% in 2024. This is a good way to test your retirement readiness. We’ll add everything up at the end of the year. It looks good so far.

Track net worth and hope for +10%

I’ve been tracking our net worth since 2006. It’s great to see the progress. This year, I’d like to see 10% gains. At this point, the gain is completely dependent on the stock market and there isn’t much I can do to influence this goal. I’ll just track it and keep my fingers crossed.

Alright! Our net worth increased 9.6% since the beginning of the year. Wow, we are almost there.

Health Goals

Exercise 3x per week

Now that I’m 50, health is job 1. I need to exercise consistently so I can stay healthy. In June, I only went to the gym 3 times. My elbows and knees were in pain. However, I walked over 20,000 steps every day in Japan. That counts toward exercise. Things are looking okay. Hopefully, my joints will be good when I get back.

Health checks

Equally important is going to see the doctors. At this age, we have more maintenance and preventative care to deal with. Here is my list for 2024.

- Colonoscopy. Done!

- Annual physical.

- Dental exam. Done!

- Glaucoma screening. I have a family history.

- Immunization. Tdap booster Done! Flu and Covid vaccine later.

Fun goals

International trip

Mrs. RB40 turns 50 this year and she wants to go on a fun memorable trip. We are in Japan! It’s a great trip so far.

Happiness level > 8

I’m a naturally happy guy so this should be relatively easy.

June was the best month I’ve had in a long time. We are having so much fun on this vacation. I thought about giving June a 9.5 because nothing is perfect. However, let’s just give it a 10. If I ever get a better month, I’ll give it a higher score. Life is good.

Help RB40Jr start a YouTube channel

RB40Jr wants to start a YouTube channel. I’ll help him get it going in the summer. This one doesn’t look good. RB40Jr lost interest in starting a channel. Maybe we can rekindle his interest this summer. He’ll have more free time then.

Net Worth (+9.6%)

I’ve been tracking our net worth since 2006. It is very motivating to see the progress we’ve made. The power of compounding is unbelievable. The stock market did well in June. Our net worth is up 9.6% since the beginning of the year. Things are looking goood.

***Important*** My best advice is to stay the course. Do not stop investing. You have to keep investing whether the stock market is going up or down. You might think stocks are too expensive, but it’ll look cheap in 10 years. Keep investing and you’ll achieve financial independence someday. Don’t try to time the market.

This is a chart of our net worth from Empower.

(Personal Capital is now Empower.) Sign up for a free account at Empower to help manage your net worth and investment accounts. I log in to check our net worth and use their free tools. It’s a great site for DIY investors.

June 2024 FIRE Cash Flow

Sorry! I wasn’t motivated to work on the cash flow spreadsheet while I was on vacation. I’m sure we had negative cash flow in June because we are spending a lot of money. It’s so much fun, though. We don’t mind splurging once in a while.

That’s it for June. Did you have a good month? Are you doing anything fun this summer?

Passive income is the key to early retirement. This year, Joe is investing in commercial real estate with CrowdStreet. They have many projects across the USA so check them out!

Joe also highly recommends Personal Capital for DIY investors. They have many useful tools that will help you reach financial independence.

Publisher: Source link