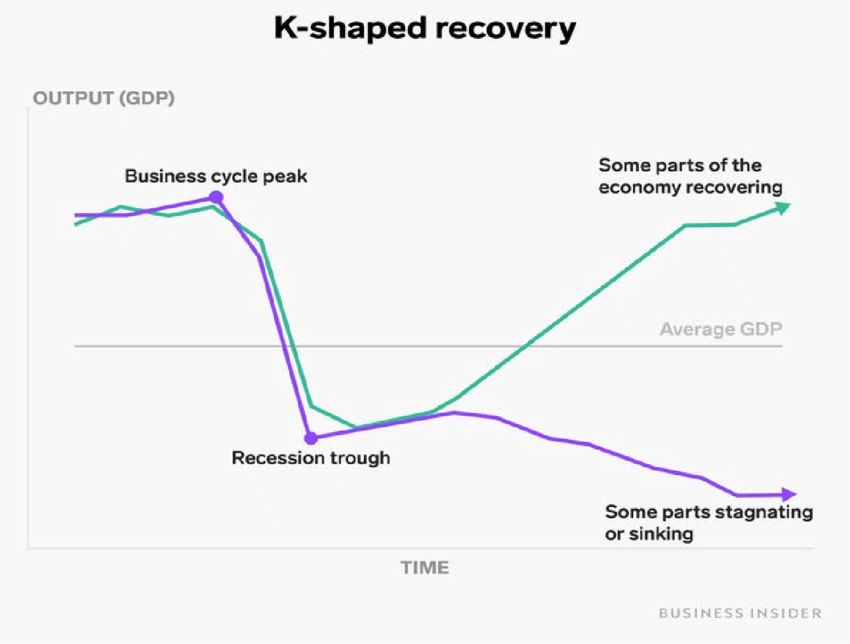

Hey everyone! Have you been paying attention to the economy? Everything is getting more expensive, and it is very difficult to find a job. Life is tough for little guys and gals. However, the top 10% are thriving due to the “K-shaped” economic recovery. In 2025, the top 10% are driving half of all consumer spending in the U.S. They are spending like there’s no tomorrow because the stock market and housing market are doing so well. In contrast, the lower and middle-class workers are living paycheck to paycheck and racking up debts. Today, let’s talk a bit about the K-shaped economy and how the RB40 household is handling this unequal recovery.

Normally, a rising tide lifts all boats. When the economy recovers, everyone usually prospers. However, this time is a bit different. There are clear winners and losers.

Winners

- Investors. The stock market is doing better than ever. If you’re an investor, you’re probably feeling wealthier than ever.

- Homeowners. Home prices are higher than ever, and this helps homeowner feels rich. U.S. homeowners are sitting on historically high amounts of equity. They can get a home equity loan if they need to. Homeowners are also reluctant to move because many of them have low-interest mortgages.

- High-earning knowledge workers. Thousands of white collar workers have been laid off recently. However, if you have experience in the right sector, you’re making big bucks. AI scientists and researchers are making upward of $450,000 per year. That’s pretty rich.

- AI companies and related. Tech and AI-related companies are doing very well. Companies are trying to cut costs by replacing human workers with AI. This will increase productivity and profits in the long term if it works out.

- Luxury goods and services companies. The top 10% feel rich, and they are ramping up their spending. Luxury goods and services companies are doing very well.

Losers

- Lower and middle-income earners. Inflation is still high. Everything is getting more expensive every day. Lower and middle-income workers are struggling to pay the ever-increasing bills, and they are racking up debt. The total household debt reached $18.388 trillion, an all-time high.

- Small businesses. Many small businesses are struggling due to the tariffs, inflation, and rising costs. Lower and middle-income workers are tightening their belts. Businesses that depend on those consumers will struggle too.

- Entry-level workers. U.S. youth (ages 16 to 24) unemployment rate reached 10.8% in July 2025. That’s way higher than the overall unemployment rate, around 4%. Large companies are trying to replace many entry-level positions with AI.

- Job seekers. Companies are not hiring right now. They are trying to cut costs with AI. The average corporate job opening receives over 250 applications. The economy is uncertain, and nobody wants to hire in this condition.

- Government workers. The current administration continues to push out federal employees and contractors. The federal government used to be a good place to work, but it’s a hostile work environment now. I don’t think they are even saving any money. The government is spending a ton of money on taking over various cities. Flying the Black Hawks around Portland costs $50,000 per day. It’s ridiculous. There will be a ton of lawsuits over the next few years.

The RB40 household

The RB40 household is doing well in this K-shaped economy. Mrs. RB40 retired, and our income is much lower than before. However, our net worth keeps increasing every month. I am feeling wealthier than ever. We are also spending more money than ever due to inflation. Groceries, gas, utilities, property tax, classes, and our son’s extracurricular activities are more expensive than ever.

Fortunately, I’m mostly successful at keeping lifestyle inflation under control. We haven’t spent any money on luxury goods or services. The only extravagant thing we splurged on was a minor kitchen remodel. We needed it, though. Our old kitchen was from the early 80s. It had a Formica countertop, an uneven ceramic tile floor, and the cabinet doors were all out of alignment. I still drive our old 2010 Mazda 5 and buy clothes from Walmart. Nobody cares how I look anyway.

All in all, we are doing quite well in this economy. Mrs. RB40 retired earlier than expected, but we were prepared for the loss of income. As long as our net worth keeps rocketing up, I am not too worried. I feel bad for the young folks and job seekers, though. It’s a tough job market.

How about you? Are you doing well in this K-shaped economy?

Joe recommends Empower for DIY investors. They have many useful tools that will help you reach financial independence.

Publisher: Source link