If you’re building out a budget for the first time and you’re being your best responsible self, it’s important to understand the advantage of turning those big non-monthly expenses/variable expenses/True Expenses/what-ever-you-call-them into more manageable monthly chunks.

We’ve made a build-your-best budget list of non-monthly expenses to help you transform those turbulent ups and downs into smooth sailing (and saving) instead.

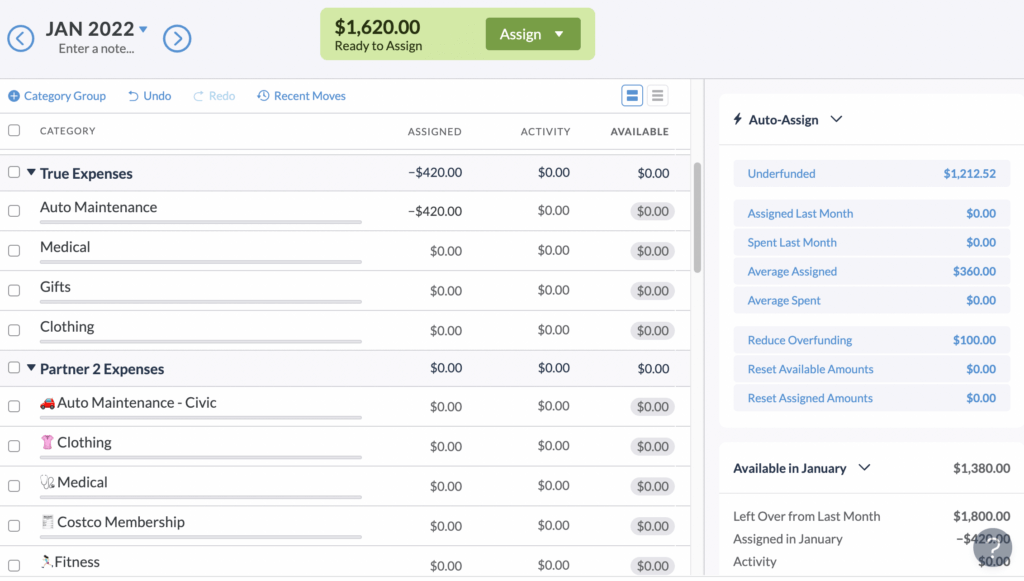

How to Budget for Non-Monthly Expenses

There’s nothing worse in the budgeting world than a rogue expense popping up and derailing your carefully calculated plan—and sometimes your checking account.

But really, non-monthly expenses aren’t unexpected…it’s more that they’re just easy to forget. Incorporating them into your monthly budget helps keep your financial plan organized and adds predictability to bills that pop up on an irregular basis.

So first, grab a notebook and a pen, or a fresh Word document, and ask yourself, “What are irregular expenses?” Don’t forget annual expenses like that AAA membership or Amazon Prime subscription that’s set to renew automatically!

Looking for more advice on how to budget for variable expenses?

Variable Expenses List

Here’s a list of expenses that you may want to include as budget categories:

- Water bill

- Trash service

- Gas bill

- Transportation costs (gas, bus pass, tolls, parking)

- Auto maintenance (oil changes, new tires)

- Car registration (license, tab renewal)

- Car insurance premiums

- Home repairs or maintenance (new roof, new hot water heater, new dryer)

- Renter/home insurance

- Health care (dental, eye care, therapy, health insurance deductible, etc.)

- Clothing

- Gifts (birthdays, anniversary, graduation, wedding, baby)

- Charitable giving (tithing, spontaneous donations, etc.)

- Computer/phone replacement

- Software subscriptions (Adobe, iCloud, Squarespace, gaming service, etc.)

- Entertainment subscriptions (Netflix, Hulu, Spotify, etc.)

- Vacation

- Gym membership/fitness

- Education

- Gaming

- Christmas

- Other Holidays (Fourth of July fireworks, Halloween candy, Mother’s Day brunch)

- Hosting

- Dates

- Beauty (hair cuts, makeup, nails, etc.)

- Property taxes (if they’re not rolled into a mortgage)

- Movies

- Phone bill

- Life insurance

- Warehouse membership (Costco, Sam’s club, Amazon Prime, etc.)

- Credit card fee (some cards have yearly costs)

- House decor

- Banking (interest owed or fees)

- Household goods

- Pet care

- Child care

- Kids’ Activities (piano lessons, summer camp, etc.)

- Kids’ Sports (travel soccer, lessons, cleats, etc.)

- School fees

- Braces

- Weddings (for yourself or others)

- Taxes

- Lawn care

- Stuff I forgot to budget for (there’s always going to be something…)

Once you’ve created your list, make sure those non-monthly expense items are included in your budget categories. Then take the total cost of each irregular expense category divided by 12, and voila! Suddenly your non-monthly expenses are as steady and predictable as the rest of your monthly bills when it comes to budgeting.

Look at you—on your way to achieving your financial goals. You’ll probably be hosting a personal finance podcast before we know it.

Do you have any non-monthly expenses that we forgot about in our list? Let us know in the comments!

YNAB’s Four Rules act as a decision-making framework for spending and our app is the perfect tool to help you save money, eliminate pesky debt payments, and finally feel in control of your finances. There’s no credit card required to try it on for size, so sign up now!

Publisher: Source link