Need tips for sticking to a budget? You are not alone. Figuring out how to stick to a budget is often the hardest part of budgeting!

Sometimes it feels like one late-night snack run, one spunky grocery shopping adventure, one unexpected expense completely derails your budgeting progress. Thanks a lot, Flaming Hot Cheetos. You ruined everything.

Good news: we have collected six budgeting tips to teach you how to stick to a budget so that you can save money and create a plan to meet your financial goals. A plan that will actually work this time. These habits don’t take long to implement (mere minutes per day), they’ll help you stay on track, and these habits pay off—quite literally. You’ll be a master of money management in no time.

Before we get too far, we want to lay out a few common budgeting pitfalls right out of the gate. If any of these sound familiar, your budget will never work, no matter how hard you try.

- Did you create a monthly budget that’s basically just a list of monthly expenses with static amounts that don’t change? Eek, it’s no wonder it’s hard! There is no such thing as a normal month!

- Is your budget planned with money you’ll get later this month, rather than the money you have right now? That’s totally a natural reflex, but you’ll never have a firm grip on your current financial reality with money that doesn’t exist in your account yet.

- Is your existing budget just tracking expenditures and has yet to change any of your spending habits? We’ve all been guilty of this at one point or another, but stick around if you really want to improve or optimize the plan for your personal finances.

If these sound familiar, there might be something wrong with your entire budgeting setup. And hey, don’t feel bad about that—no one ever teaches us how to budget. But we have a proven system that works. Fix the problem now to finally reach those financial goals you’ve been dreaming of.

If you made it past the ringer, or even if you’re just hooked enough and want to keep reading, let’s talk about the best tricks and tips for how to stick to a budget.

What is budgeting? Learn everything you need to know in our comprehensive guide.

How to Stick to a Budget

Habit One: Assign Money When It Arrives

When a paycheck, birthday check, or any money at all arrives, that’s the moment it should be entered in your budget. Not before, and not too long after. Not only does this make paydays even more magical, this gets you in the right (but sometimes foreign) mindset to only budget the money you have.

In YNAB, if you’re someone who has accounts linked to your budget and your paychecks get deposited automatically to your bank account, this can be pretty automated. Whew—a habit you don’t even have to remember to do? Sign me up.

Habit Two: Budget to Zero

Right after money comes in, you want to give every one of those dollars a job. Give them an assignment in your budget, a task. You are the boss! The question to ask is always, “What does this money need to do before more money arrives?”

Learn YNAB’s first rule to less financial stress: Give Every Dollar a Job

And when we say budget to zero, we mean budget to zero. ‘Tis the joy and power of a zero-based budget: and the key to financial clarity. Leave no dollar without a job, and no dollars hanging out in the Ready to Assign header in your YNAB budget. Employ them all!

Habit Three: Check the Budget Before Spending

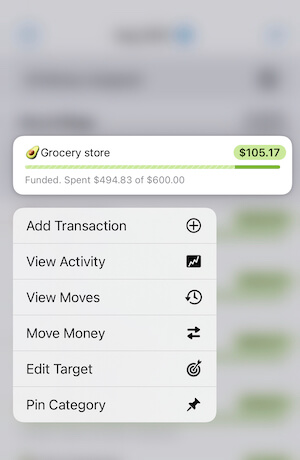

Want a new t-shirt? Well, how much is in your clothing category? $90? Ok, that’ll get you a t-shirt! A downright supple t-shirt at that! (Welcome to YNAB rich, my friend). This goes for going to the grocery store—check your budget before you make that grocery list. The coffeeshop—don’t reach for that debit card until you’ve checked your budget. You get the idea.

Some days you’ll get a resounding YES to spending money, and other times you’ll get a NOT YET in response, and still others you’ll realize that a new pair of jeans just wasn’t quite as important as your passing urge would have you believe. Think of your budget as an ever-present accountability partner who politely helps you evaluate those oh-so-tempting impulse purchases. It’s a great habit to just check your overall budget daily. Anchoring this habit to an existing habit is a good way to build it in. Some people do it when they are having their morning coffee, some people do it before they turn in for bed.

I flip through my transactions while eating a piece of toast for breakfast—it’s a good time, I’m living a wild life over here.

Daily check-ins keep the budget top of mind—and more importantly, it keeps the budget based on my priorities right in front of me.

Want an easy way to check your most used categories? iOS users can add widgets to their home screen for an at-a-glance view of things like grocery spending, fun money, or eating out.

Habit Four: Enter Day-to-Day Spending on Your Phone

We all have certain categories that we spend from on a day-to-day basis: groceries, gas, dining out, etc. It’s best to get into the habit of entering these transactions right when they happen—at the point of sale. Start the gas transaction while the car is filling up with gas. Don’t drive away from the grocery store until you’ve entered the transaction.

We’re not saying you should enter all your spending (though if you’re just getting started—Dave, our bootcamp teacher, recommends you do this manually just for a week while you’re learning the app), this is less intimidating. But it’s the day-to-day categories (not the monthly bills) that get people in trouble.

If you can use Direct Import in YNAB, it’s pretty handy to have it act as a failsafe, a soft landing in case you miss any transactions, and then you don’t need to remember the due date for the electric bill. So long as the amount is the same, and the date is within ten days, anything they enter themselves will match up when it imports, so you don’t have to worry about duplicates.

Habit Five: Reconcile Frequently

Reconciliation in your budget is the act of making sure your budget matches your bank account and credit card. If the account balances aren’t right, there’s no chance the budget is right. Reconciliation is like laundry and dishes: the longer you put it off the more there is to do. Frequent—even daily reconciliation is a terrific habit that will prevent a feeling of being overwhelmed down the road.

After reconciling your checking account, savings account, and credit card accounts, check the budget for overspending. Think of that as the closing task on the habits. Start in the accounts, end with the budget. That way, everything is up to date and accurate like an accountant closing end-of-year books. Unless they work at Enron, in that case all bets are off.

Habit Six: Give Yourself Permission to Change the Budget

Budgeting is the process of prioritizing and reprioritizing. It’s not a “set it and forget it” long-term plan. You’ll move money from one category to another to cover overspending—there’s not a month that goes by without me doing this at least 11 times. Call it robbing Peter to Pay Paul. Or my personal favorite, WAMing (Whack-a-Moling— like the arcade game where a mole moves from one hole to another).

Make changes to your budget, your categories, your targets whenever you need to or even when you just want to (increase fun money by $10? Ok!). Allowing yourself some wiggle room for those nights where you just HAVE to pick up take out will actually help you stick with budgeting for the long haul.

In the early days of budgeting, you might still be figuring out what your priorities are. When you make a change to your budget, it’s because you’re thinking, learning and adjusting. You’ll find your groove with time and practice. Getting it right the first time is nowhere near as important as developing the habit of tweaking and refining.

Ready to create a budget you can stick to? Achieve your savings goals, build an emergency fund, eliminate credit card debt, and more! Try YNAB for free for a month. No credit card or commitment required!

Publisher: Source link